Page 151 - 2024-25 GMS研習會手冊

P. 151

Grant payments amount was received before March.

All grant payments will be remitted to bank accounts especially opened to receive INR funds or to a club-

controlled FCRA account. Grant funds will not be released to a bank account in India unless all general payment All final reports need to meet all general reporting requirements as listed in section IX. In addition, the grant

conditions listed below have been met. Either the staff need to determine that enough funds are available from

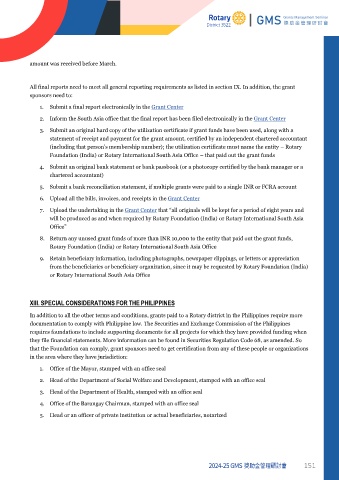

sponsors need to:

contributions made within India or the sponsors need to provide documentation showing that the bank account is

registered under the FCRA. Otherwise, the payment will be placed in a queue and paid on a first-come, first- 1. Submit a final report electronically in the Grant Center

served basis only when more contributions (within India) are made and enough funds are available. Grant 2. Inform the South Asia office that the final report has been filed electronically in the Grant Center

sponsors need to ensure that funds received in a FCRA-registered bank account are not commingled with local

funds. 3. Submit an original hard copy of the utilization certificate if grant funds have been used, along with a

statement of receipt and payment for the grant amount, certified by an independent chartered accountant

(including that person’s membership number); the utilization certificate must name the entity – Rotary

District grants Foundation (India) or Rotary International South Asia Office – that paid out the grant funds

Payment is contingent upon the approval of a detailed spending plan that includes an itemized budget for each 4. Submit an original bank statement or bank passbook (or a photocopy certified by the bank manager or a

listed project or activity. Grant funds will be paid only to the district bank account, which needs a name that chartered accountant)

identifies both the district and the project (for example, Rotary District 0000 District Grant 12345). District grant

funds will not be released until the previous Rotary year’s district grant is closed. Funds are not available after the 5. Submit a bank reconciliation statement, if multiple grants were paid to a single INR or FCRA account

close of the implementation year. If sponsors don’t meet all payment requirements by 31 May of the 6. Upload all the bills, invoices, and receipts in the Grant Center

implementation year, the grant will be canceled.

7. Upload the undertaking in the Grant Center that “all originals will be kept for a period of eight years and

will be produced as and when required by Rotary Foundation (India) or Rotary International South Asia

Global grants Office”

Funds won’t be released until all sponsor contributions have been submitted to The Rotary Foundation and any 8. Return any unused grant funds of more than INR 10,000 to the entity that paid out the grant funds,

payment contingencies have been met. Grant funds will be paid to the account provided by the grant sponsors. Rotary Foundation (India) or Rotary International South Asia Office

9. Retain beneficiary information, including photographs, newspaper clippings, or letters or appreciation

from the beneficiaries or beneficiary organization, since it may be requested by Rotary Foundation (India)

Grant reporting

or Rotary International South Asia Office

Progress reports on grant funds paid out from Rotary Foundation (India) or from Rotary International South Asia

Office through 31 March are due by 31 May of that same year. Final reports are due two months after the grant’s

completion. All progress reports need to meet all general reporting requirements as listed in section IX. In XIII. SPECIAL CONSIDERATIONS FOR THE PHILIPPINES

addition, the grant sponsors need to:

In addition to all the other terms and conditions, grants paid to a Rotary district in the Philippines require more

1. Submit a progress report electronically in the Grant Center

documentation to comply with Philippine law. The Securities and Exchange Commission of the Philippines

2. Inform the South Asia office that the progress report has been filed electronically in the Grant Center requires foundations to include supporting documents for all projects for which they have provided funding when

3. Submit an original hard copy of the utilization certificate if grant funds have been used, along with a they file financial statements. More information can be found in Securities Regulation Code 68, as amended. So

statement of receipt and payment for the grant amount, certified by an independent chartered accountant that the Foundation can comply, grant sponsors need to get certification from any of these people or organizations

(including that person’s membership number); the utilization certificate must name the entity – Rotary in the area where they have jurisdiction:

Foundation (India) or Rotary International South Asia Office – that paid out the grant funds 1. Office of the Mayor, stamped with an office seal

4. Submit an original bank statement or pass book (or a photocopy certified by the bank manager or a 2. Head of the Department of Social Welfare and Development, stamped with an office seal

chartered accountant)

3. Head of the Department of Health, stamped with an office seal

5. Upload all the bills, invoices, and receipts in the Grant Center

4. Office of the Barangay Chairman, stamped with an office seal

5. Head or an officer of private institution or actual beneficiaries, notarized

If the grant funds were not used for any reason, include an original bank statement or bank passbook (or a

photocopy certified by the bank manager or a chartered accountant) indicating the date on which the grant

amount was credited and a statement explaining why the grant amount has not yet been used, even if the grant

2024-25 GMS 獎助金管理研討會 2024-25 GMS 獎助金管理研討會 151